The Chinese health food (dietary supplement) industry is undergoing a transitional phase, characterized by stricter product approval and stronger regulatory supervision.

According to the information released by the Center for Food Evaluation, State Administration for Market Regulation (SAMR) and the Special Food Information Query Platform, in the first half of 2025, the SAMR issued a total of 858 health food registration approvals, 116 of which are new health food products.

CIRS Group conducted a detailed summary of these 116 new products, and analyzed from the following points.

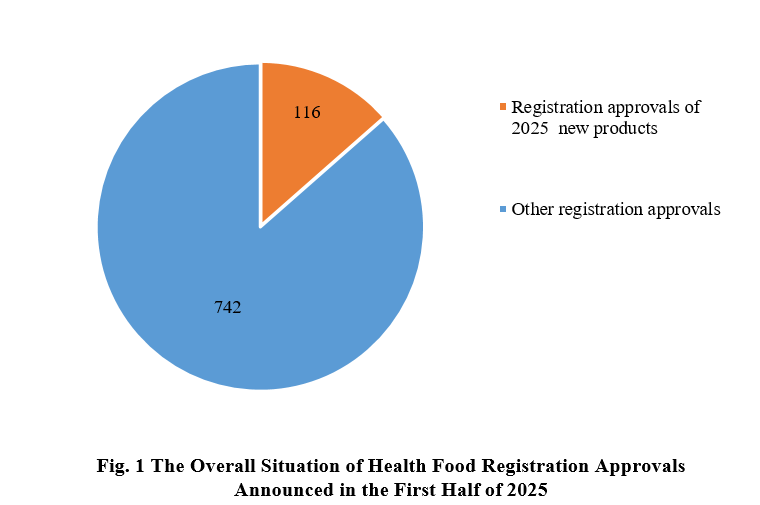

1. The Overall Situation of Health Food Registration Approvals

Among the 858 registration approvals, 116 are new products, accounting for 13.5% of the total. The other 742 registration approvals, not for new products, possibly are renewal registration and change registration.

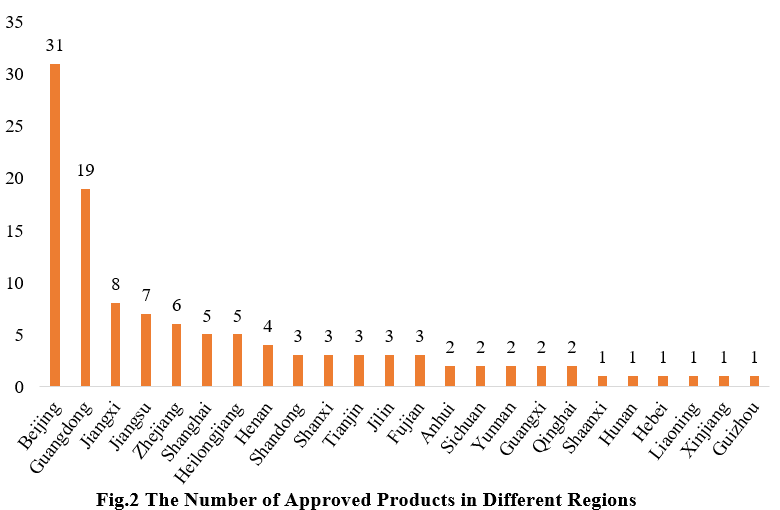

2. The Number of Approved Products in Different Regions

The 116 approved new products are from 24 provinces (municipalities and/or autonomous regions). As shown in Fig.2, new products are mainly concentrated in Beijing, Guangdong and the Yangtze River Delta (including Jiangsu, Zhejiang, and Shanghai), which are known for strong scientific research capabilities and robust economic development.

Note: If the applicant includes more than one enterprises and comes from different provinces, each province is included in the statistics.

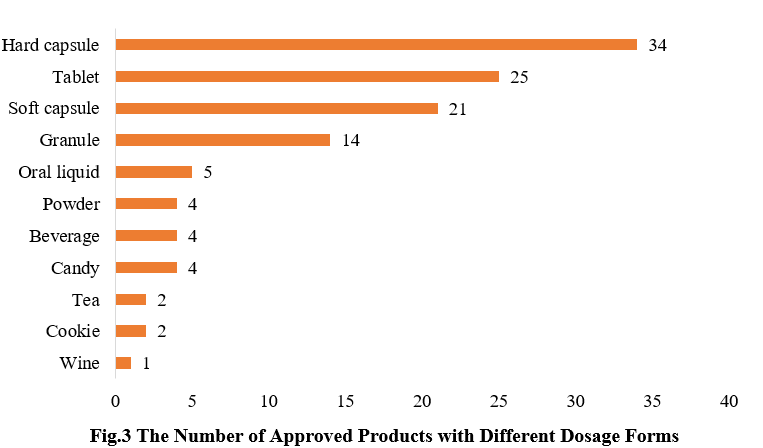

3. The Number of Approved Products with Different Dosage Forms

The dosage forms of approved new products include capsules, tablets, powders, and oral liquids. Among them, hard capsule products received the largest number of approvals (34), accounting for 29.3%, followed by tablet products (25), accounting for 21.6%. In addition to the common health food dosage forms, there are also some food forms that have received registration approvals, such as cookies and candies.

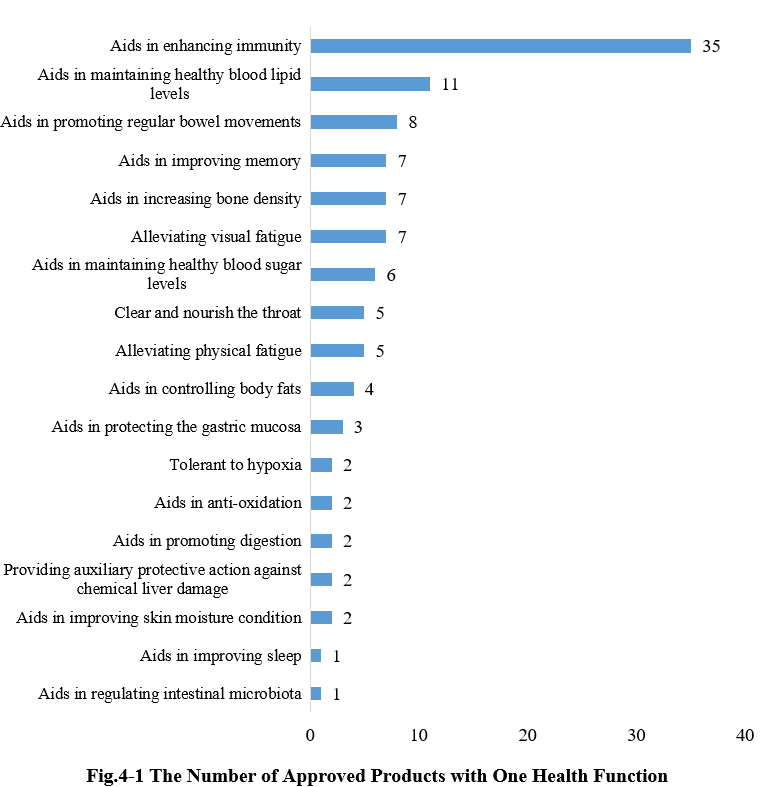

4. The Number of Approved Products with Different Health Functions

4.1 Single health function

As shown in Fig. 4-1, there were 110 new products approved with the single health function, among them, products with the health function of “aids in enhancing immunity” received the largest number of approvals, with the number of 35.

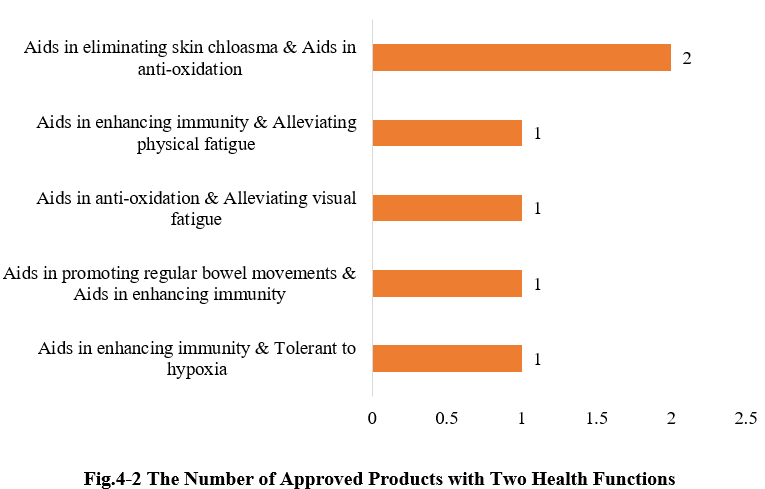

4.2 Two health functions

Except for those new products with single health function, there are also six products approved with two health functions (shown in Fig. 4-2) in the first half of 2025.

5. CIRS Comments

5.1 The health food industry is expected to thrive

In the first half of 2025, there are only 116 new products approved, CIRS Group attributes this to two key factors: First, requirements of regulatory review continue to be detailed to ensure higher post-market safety. Secondly, the change of registration certificate for health foods with no validity period and no technical requirements officially launched at the end of 2024, driving older products toward compliance upgrades in a more standardized manner.

Whether for new products or older products with no validity period and technical requirements, companies must submit truthful, complete, and compliant documentation during registration to avoid rejection or repeated requests for corrections.

5.2 The first new function of health food has been open for public option

On April 24, the SAMR released Directory of Health Functions Available to be Claimed by Health Food—Aids in Maintaining Joint Health (Draft) for public options. This new functional claim was developed by SAMR in collaboration with industry associations, research institutions, and academic organizations. With evolving lifestyles and global health needs, the health function innovation tends to be life-oriented, targeted and science-backed in the future.

5.3 Tighter regulation is cleaning up the market

On June 28, the SAMR and the National Health Commission (NHC) jointly issued an announcement to include sildenafil-like and tadalafil-like substances in the List of Non-edible Substances That May Be Illegally Added to Foods. On the same day, the SAMR released the "Open Competition" Work Plan for Food Supplementary Testing Methods, a mechanism to encourage innovation through competitive bidding for methodological development.

The illegal addition of above substances is most prevalent in products claimed as "alleviate physical fatigue" or "enhance immunity". Manufacturers adulterate products with these substances, disguise packaging as health foods, and distribute them via e-commerce platforms or offline channels. The two new regulations show regulators mean business, cracking down on illegal products and send a clear industry warning: there is no "gray zone" in health food, only compliance ensures market survival.

Data Source: Special Food Information Query Platform of State Administration for Market Regulation (SAMR) and new approval announcements.

Note: There may be a lag in the data release of the Special Food Information Query Platform. The data in this article is only for reference, and the actual situation is subject to the official announcement.

If you need any assistance or have any questions, please get in touch with us via service@cirs-group.com.